maryland earned income tax credit 2019

Allowable Maryland credit is up to one-half of the federal credit. Did you receive a letter from the IRS about the EITC.

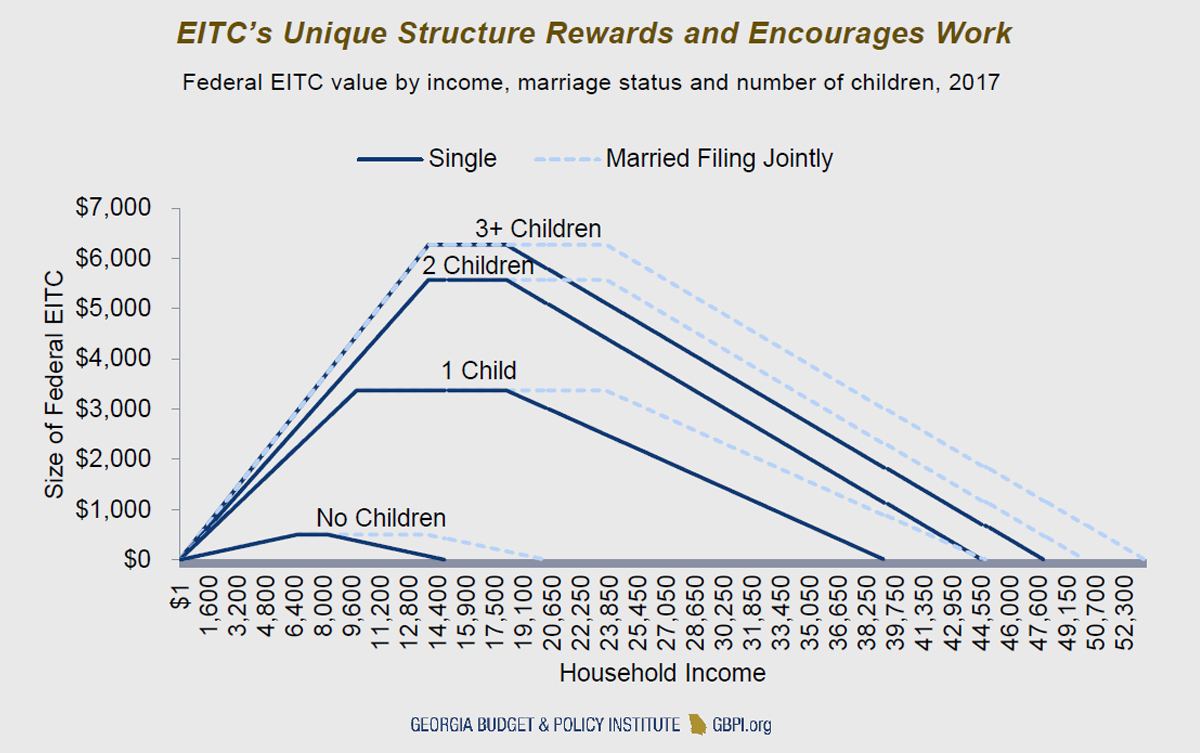

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute

Have a valid Social Security number by the due date of your 2021 return including extensions Be a US.

. Even though you can no longer eFile 2019 Tax Returns you can estimate and calculate your 2019 Taxes here. The allowable Maryland credit is up to one-half of the federal credit. Allowable Maryland credit is up to one-half of the federal credit.

The Maryland earned income tax credit EITC will either reduce or. To be eligible for the federal. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following.

MORE SUPPORT FOR UNEMPLOYED MARYLANDERS. File 2019 Tax Return. The local EITC reduces the amount of county tax you owe.

File 2018 Tax Return. Since MD uses your adjusted gross income to calculate MD tax any foreign earned income excluded on the federal return will be excluded from your MD return. 2019 Tax Returns.

In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals. Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 20m jobs. To qualify for the EITC you must.

Line 13 of the Form 502LC is your State tax credit. Then complete Form 502LC. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

50162 55952 married filing jointly with three or more qualifying children 46703 52493 married filing jointly with two qualifying children. 50 of the earned income credit allowable for the taxable year under 32 of the Internal Revenue Code. You must file your Maryland income tax return on Form 504 and complete through the line for credit for fiduciary income tax paid to another state on the Form 504.

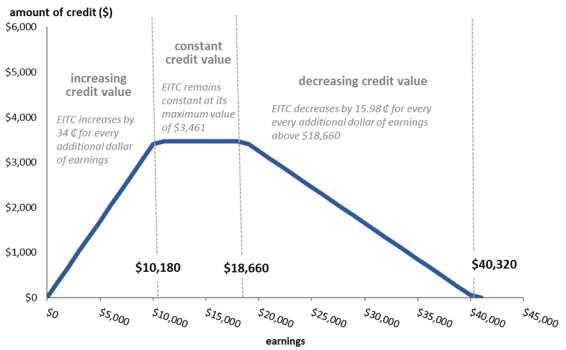

The 2019 Tax Year Earned Income Tax Credit or EITC is a refundable tax credit aimed at helping families with low to moderate earned income. Have investment income below 10000 in the tax year 2021. Earned income includes all the taxable income and wages you get from working for someone else yourself or from a business or farm you own.

In the EIC qualification assistant use your 2019 amount when asked for your earned income. In TurboTax go to deductions and credits and click on eic and you will be asked If your 2019 earned income is higher than your 2021 earned income of 00 you could get more for the EITC. Does State of Maryland also allow the foreign earned income exclusion.

View My Prior Year Returns. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years. 0 1499 per state.

Some taxpayers may even qualify for a refundable Maryland EITC. Its free to sign up and bid on jobs. File 2016 Tax Return.

Your income wherever earned is subject to MD taxation. If MD is your state of domicile then you are a MD resident for tax purposes. In 2019 86000 Maryland workers paid taxes this way and 60000 of them had incomes low enough that they would have qualified for the tax credit if allowed.

The table shows the number total amount and average amount of EITC claims by states. Election to use prior-year earned income You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021 earned income. Below are statistics on current and previous years Earned Income Tax Credit EITC return by states.

File 2015 Tax Return. For 2021 you are allowed to use your 2019 or 2021 earned income based on whichever one gives you the highest credit. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

File 2014 Tax Return. File 2017 Tax Return. I have a client whose domicile is state of MD but he has resided and worked in Foreign country from 2019.

49194 54884 married filing jointly with three or more qualifying children. Earned Income Tax Credit EITC The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. Earned Income Tax Credit For 2019.

A resident may claim a credit against the State income tax for a taxable year in the amount determined under subsection b of this section for earned income. For tax year 2020 the CAA allows taxpayers to use their 2019 earned income if it was higher than their 2020 earned income in calculating the Additional Child Tax Credit ACTC as well as the Earned Income Tax Credit EITC. The earned income tax credit or.

If you work and have W-2 andor 1099 income at a certain level let the EITC work for you. Thats what the law allows. Most taxpayers who are eligible and file for a federal EITC can receive the Maryland state and local EITC.

Reduces the amount of Maryland tax you owe. 50162 55952 married filing jointly with three or more qualifying children 46703 52493 married filing jointly with two qualifying children. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following.

2019 Maryland Code Tax - General Title 10 - Income Tax Subtitle 7. 2019 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide electronic or written notice to an employee who may be eligible for the federal and Maryland EITC. Your employees may be entitled to claim an EITC on their 2019 federal and Maryland resident income tax.

06-15-2020 0146 AM. This amount should be entered on Line 1 of the Income Tax Credit Summary section of the Form 502CR. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund.

Allowable Maryland credit is up to one-half of the federal credit. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following. Have worked and earned income under 57414.

Some part of his wages can be excluded by Foreign earned income exclusion Form 2555 on Federal return.

The Earned Income Tax Credit Eitc How It Works And Who Receives It Everycrsreport Com

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Louisiana Releases Required Annual Earned Income Credit Notice Compliance Poster Company

Irs Cp 79a Earned Income Tax Credit Two Year Ban

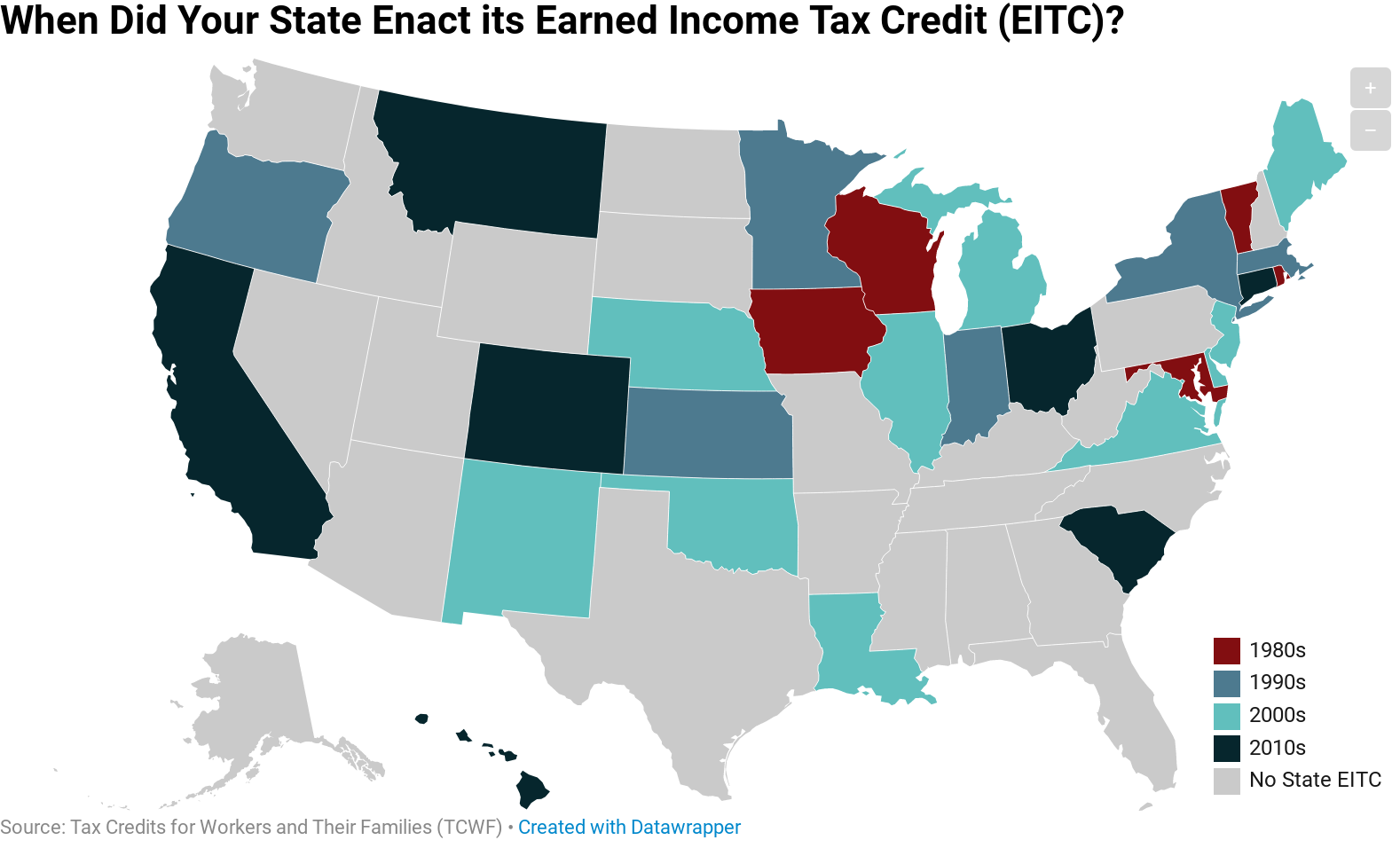

How Do State Earned Income Tax Credits Work Tax Policy Center

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Eic Frequently Asked Questions Eic

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

What Are Marriage Penalties And Bonuses Tax Policy Center

Earned Income Credit H R Block

Why We Should Expand The Earned Income Tax Credit Prosperity Now

Earned Income Tax Credit Now Available To Seniors Without Dependents